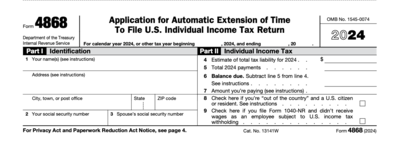

If you are requesting a personal income tax return, it’s likely you filed on Form 1040, 1040-SR, 1040A or 1040EZ. Step 4: Enter form usedĮnter the form you used to file your federal income tax return on line 6. If you leave line 5 blank, the IRS will mail your tax return to your current address. If you want your tax return sent directly to a third party, such as a bank evaluating your mortgage application, you can enter their name, address and phone number on line 5. If your current address is different than the address you report on your past-filed returns, enter that previous address on line 4. Step 3: Enter addressĮnter your current address on line 3.

If you filed a joint return for any of the years you are requesting copies, then you must also provide your spouse’s name and Social Security number on line 2. Step 2: Enter required dataĮnter your name and Social Security number on line 1. You can download this form from the IRS website. The only way you can obtain copies of your tax returns from the IRS is by filing Form 4506 with the IRS. If you used TurboTax Online, you can log in and print copies of your tax return for free. If you filed your taxes with a TurboTax CD/download product, your tax return is stored on your computer, so you can print a copy at any time. Once the IRS receives your request, it can take up to 60 days for the agency to process it. You can request copies by preparing Form 4506 and attaching payment of $50 for each one. The Internal Revenue Service (IRS) can provide you with copies of your tax returns from the most recent seven tax years.

0 kommentar(er)

0 kommentar(er)